The insurance you use for a red eye depends entirely on your “chief complaint”—the specific words you use to describe your problem to the doctor’s office.

- A medical complaint like “I have a red, painful eye” triggers your medical insurance.

- A routine complaint like “I need a vision check-up” triggers your vision insurance.

Recommendation: Frame your eye issue as a medical symptom, not a vision problem, to ensure you are using the correct benefits and minimizing out-of-pocket costs for diagnosis and treatment.

Walking into an optometrist’s office with a red, irritated eye presents a surprisingly complex financial puzzle. Your first instinct might be to pull out your vision insurance card, but this is often the first and most costly mistake. The U.S. healthcare system creates a confusing, artificial wall between “vision care” (for glasses and routine exams) and “medical eye care” (for diseases, injuries, and infections). For a patient in discomfort, navigating this distinction feels arbitrary and frustrating. The key to unlocking the right coverage isn’t in the problem itself, but in how you communicate it.

Most advice simply states the obvious: medical insurance for medical problems, vision insurance for vision problems. This is true, but unhelpful. It fails to equip you with the strategic language and understanding of the system needed to act as a savvy manager of your own health portfolio. The real issue is that your eyes are not separate from your body, but the insurance system often treats them as if they are. This article breaks down that wall. We won’t just tell you which card to use; we will explain the financial and systemic logic behind the “chief complaint” switch. This perspective shift will empower you to use your benefits strategically, save money, and, most importantly, transform your annual eye exam from a simple vision check into a powerful screening tool for your overall health.

This guide provides a practical framework for navigating the intersection of vision and medical insurance. By understanding the underlying principles, you can make informed financial decisions that support your holistic well-being.

Summary: A Strategic Guide to Navigating Eye Care Insurance

- Why Your Eyes Are the Window to Your Heart, Kidney, and Brain Health?

- How to Connect Your Optometrist With Your Primary Care Doctor?

- Annual Wellness Visit or Symptom-Based Visit: Which Saves Money Long Term?

- The Danger of Treating Eyes as Separate From the Rest of the Body

- Problem & Solution: Creating a Vision Care Budget for Every Decade of Life

- Private Clinic or Retail Chain: Which Offers Better Continuity of Care?

- How to Determine Your Exam Frequency Based on Risk Factors?

- Why Your Optometrist Might Detect Your High Cholesterol Before Your GP?

Why Your Eyes Are the Window to Your Heart, Kidney, and Brain Health?

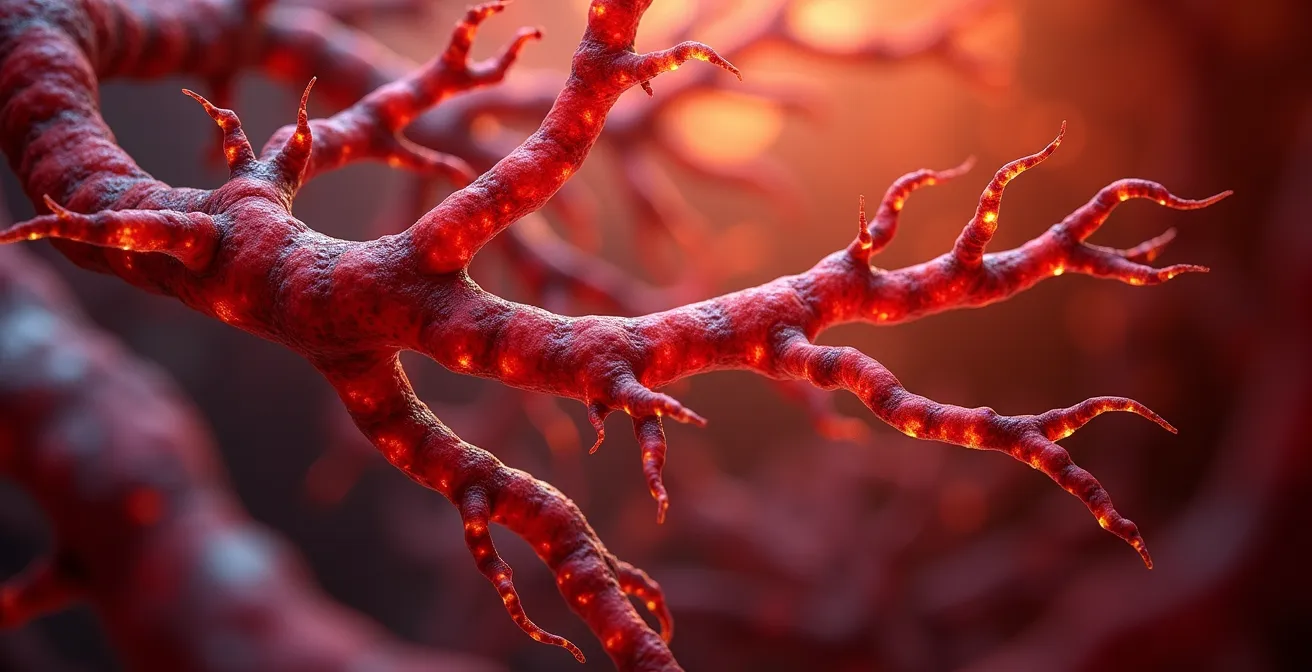

The old saying is more than a poetic metaphor; it’s a medical fact. The eye is the only place in the body where blood vessels and the optic nerve can be directly observed in a non-invasive way. This unique access provides a live look at your circulatory and neurological health. An optometrist isn’t just checking your prescription; they are screening for early signs of systemic diseases like diabetes, hypertension, high cholesterol, and even certain cancers. For example, tiny hemorrhages or new, fragile blood vessels in the retina can be the first indication of diabetic retinopathy.

This makes the annual eye exam one of the most cost-effective diagnostic tools in your healthcare arsenal. The financial implications are significant, as 90% of diabetes-related vision loss can be prevented with early detection and treatment, according to the Centers for Disease Control and Prevention. The eye provides data points long before symptoms might appear elsewhere. This is why research in the field is so active; The National Institutes of Health, for example, awarded a $4.8 million grant to develop technology that can observe red blood cell movement in real-time to identify biomarkers for diabetes and hypertension.

The intricate network of blood vessels in your retina is a microcosm of your entire circulatory system. What an optometrist sees here often reflects the health of much larger, unseen vessels near your heart and brain.

As this image suggests, the delicate, branching structures are not just for sight; they are a systemic health indicator. Any damage, blockages, or abnormalities here are a critical warning sign that should be communicated to your primary care physician immediately. Viewing your eye exam as an isolated event is a missed opportunity for proactive health management.

How to Connect Your Optometrist With Your Primary Care Doctor?

The most valuable health data from your eye exam is useless if it stays siloed within the optometrist’s office. You, the patient, must act as the bridge between your eye care provider and your primary care physician (PCP). This requires proactive and specific communication. Do not assume the offices will communicate automatically; they often don’t unless you direct them to. The key is to understand the basic rules of engagement between vision and medical insurance first, which dictate the entire billing process.

The distinction between what medical and vision insurance cover is based on the “chief complaint.” The following table clarifies the typical coverage, based on information from an analysis by St. Lucie Eye Associates, but remember the trigger is always the reason for your visit.

| Type of Care | Medical Insurance | Vision Insurance |

|---|---|---|

| Eye Injuries & Trauma | ✓ Covered | ✗ Not Covered |

| Glaucoma/Cataracts Treatment | ✓ Covered | ✗ Not Covered |

| Diabetic Eye Exams | ✓ Covered | ✗ Not Covered |

| Routine Vision Exams | ✗ Not Covered | ✓ Covered |

| Prescription Glasses/Contacts | ✗ Not Covered | ✓ Covered |

Knowing these rules, you can facilitate the transfer of information. You must explicitly authorize the release and sharing of your medical records. The following plan provides a script to ensure this critical information-sharing happens, transforming you from a passive patient into an active healthcare navigator.

Action Plan: Ensuring Your Doctors Communicate

- During scheduling, inform both offices you want care coordination for your overall health.

- At check-in, provide both doctors’ contact information (name, practice, phone number) to the receptionist.

- Use this exact phrase with your optometrist: “I authorize your office to send a clinical summary of my exam to my primary care doctor.”

- Ask for confirmation of the transmission method (e.g., secure fax, patient portal) and when it will be sent.

- Follow up with your PCP’s office within two weeks, asking: “Did you receive the report from my optometrist regarding my retinal health?”

Annual Wellness Visit or Symptom-Based Visit: Which Saves Money Long Term?

From a purely financial perspective, the answer is unequivocally the annual wellness visit. The confusion arises because patients often try to use the wrong tool for the job. A vision insurance plan is a pre-payment tool for a predictable, routine service. A medical insurance plan is a risk-mitigation tool for unpredictable health events. Trying to use a vision plan for a medical issue like a red eye is like trying to use a gift card to pay for a car repair; the systems aren’t designed for it.

The cost difference is stark. Looking at the national average cost of an annual routine eye exam, patients with vision coverage pay around $25, while those without pay an average of $136. This demonstrates the value of vision plans for routine care. However, when a symptom like “red eye” is the chief complaint, the visit becomes a diagnostic, medical one. Here, your medical insurance applies, and you’ll typically pay a copay or toward your deductible. While this might be more than the $25 vision copay, it’s far less than the cost of an entire medical eye exam out-of-pocket.

The long-term savings of annual visits are monumental. They prevent small problems from becoming catastrophic ones. According to the CDC, the estimated economic impact of major vision problems is over $145 billion for adults over 40 in the United States. Many of these costs stem from treating advanced conditions that could have been managed if caught early. Skipping an annual $136 exam to save money today could lead to thousands in treatment costs and lost productivity tomorrow. This isn’t just healthcare; it’s financial triage. You are making a small, planned investment to avoid a massive, unplanned expense.

The Danger of Treating Eyes as Separate From the Rest of the Body

The greatest danger in the artificial separation of vision and medical care is not financial—it’s clinical. When we treat the eyes as isolated organs responsible only for sight, we miss a wealth of critical health data. This siloed approach can delay the diagnosis of life-threatening conditions, turning manageable issues into chronic diseases. The insurance system may draw a line between the eye and the body, but biology does not. A problem seen in the eye is often a symptom of a problem with the entire system.

This connection is well-documented. As Stephen A. Burns of the Indiana University School of Optometry notes, the unique visibility of blood vessels and nerves in the eye provides a powerful diagnostic advantage.

The eye can reveal clues about conditions such as diabetes, heart disease, kidney disease, sickle cell anemia, and even Alzheimer’s disease.

– Stephen A. Burns, Indiana University School of Optometry

The link between diabetes and eye health is particularly strong and serves as a prime example. The same high blood sugar that damages other parts of the body also damages the delicate vessels in the retina. Data shows that for adults with diagnosed diabetes, 39% have chronic kidney disease and 12% experience vision loss or blindness. These are not separate conditions; they are concurrent complications of the same underlying disease, often visible first in the eye.

Viewing the body as an interconnected system, with the eye as a key data port, is essential for proactive health management. The visual below represents this holistic connection, where the health of one part intrinsically reflects the health of the whole.

Ignoring this connection means willingly overlooking one of the earliest and most accessible warning systems your body has. It’s a risk no patient should be forced to take simply because of confusing insurance structures. Your health portfolio requires a holistic view.

Problem & Solution: Creating a Vision Care Budget for Every Decade of Life

Managing your “health portfolio” requires a long-term financial strategy, and vision care is a critical line item. The needs and costs associated with your eyes evolve significantly throughout your life. A proactive budget, rather than a reactive response to problems, can save you thousands and ensure you are using tax-advantaged tools like Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA) effectively.

In your 20s and 30s, the focus is often on managing digital eye strain and considering discretionary procedures like LASIK. Costs are relatively low, centering on an annual exam and perhaps a single pair of glasses or a year’s supply of contacts. This is the time to build the habit of maxing out any employer-matched FSA/HSA contributions, saving 20-30% on these predictable costs.

Entering your 40s and 50s, a new, non-negotiable expense arrives: presbyopia, the natural age-related loss of near vision. This is when the cost of eyewear can jump significantly with the need for progressive or bifocal lenses. Your budget must now account for more expensive hardware. This is also the decade when the risk for glaucoma and other chronic conditions begins to rise, making the annual medical eye exam even more crucial as a screening tool.

From your 60s onward, the budget shifts from vision correction to disease management and surgical planning. The likelihood of developing cataracts, macular degeneration (AMD), or dealing with advanced glaucoma increases. Your vision care budget is now deeply intertwined with your medical budget. It should include funds for more frequent monitoring, potential surgical co-pays or deductibles, and adaptive low-vision aids. Using FSA funds, which are often “use-it-or-lose-it,” to schedule these comprehensive exams in the fourth quarter is a smart financial move.

Private Clinic or Retail Chain: Which Offers Better Continuity of Care?

When choosing an eye care provider, patients often face a choice between a private optometry practice and a large retail chain. The initial price can be tempting; for a basic exam, Sam’s Club offers the most affordable option at $45-50, with other retail chains averaging around $70, compared to $100-$200 at many private clinics. While the upfront savings at a retail chain are clear, it’s crucial to evaluate this decision through the lens of long-term value and what we call “continuity of care as an asset.”

Continuity of care refers to the value of seeing the same doctor or practice over many years. This provider builds a detailed, long-term record of your ocular health. They are not just seeing your eyes as they are today; they are comparing today’s data to a baseline from 2, 5, or 10 years ago. This historical context is invaluable for detecting subtle, slow-progressing diseases like glaucoma, where a tiny change in optic nerve pressure or shape over five years can be the only sign.

A retail chain may have higher doctor turnover, and you may see a different optometrist with each visit. While each exam may be clinically sound, the lack of a consistent relationship means this powerful longitudinal data is lost. You are paying for a transaction, not building a health asset. The private clinic model is structured around fostering this long-term relationship. The slightly higher exam fee is, in essence, an investment in this continuity of care asset.

Case Study: The Value of a Baseline

For residents in communities like Tamarac, Florida, the benefit of an established practice is clear. Local eye doctors report that by comparing new retinal photos to images from previous years, they can detect the earliest signs of hypertensive retinopathy (damage from high blood pressure). This includes subtle narrowing of arteries or tiny leaks that would be invisible to a doctor seeing the patient for the first time without a baseline. This early detection prompts immediate referral to a PCP for blood pressure management, potentially preventing a future stroke or heart attack.

How to Determine Your Exam Frequency Based on Risk Factors?

The standard “annual eye exam” is a good rule of thumb, but a truly strategic approach to health management requires personalizing this frequency based on your specific risk factors. Not everyone’s risk is equal, and your exam schedule should reflect that. This is a conversation you must have with your optometrist, who will act as your co-manager for this part of your health portfolio. Your age, family history, race, and overall health status are all critical data points in this calculation.

Certain conditions automatically move you into a higher-risk category. The most significant is diabetes. The clinical guidelines are unequivocal: anyone with diabetes requires a comprehensive dilated eye exam at least once a year. This is not optional. Yet, the reality is stark: it’s estimated that less than 50% receive annual diabetic eye exams in the U.S., a staggering compliance failure that leads directly to preventable vision loss. If you have diabetes, your annual exam is a non-negotiable medical necessity, billed to your medical insurance.

Other risk factors also demand increased vigilance. A family history of glaucoma, particularly if you are of African or Hispanic descent, significantly increases your personal risk. High myopia (severe nearsightedness) is a known risk factor for retinal detachment. Furthermore, certain systemic medications, like steroids, can have ocular side effects such as cataracts or increased eye pressure. Any of these factors may prompt your doctor to recommend exams every six months, or to perform more specific tests during your annual visit. The key is to be transparent with your optometrist about your full medical history so they can create the right surveillance plan for you.

Key Takeaways

- Your “chief complaint” (the reason you state for your visit) determines whether medical or vision insurance is billed.

- The eye is a key systemic health indicator; a comprehensive eye exam is a screening tool for diabetes, hypertension, and more.

- Continuity of care with a single provider creates a valuable health asset by establishing a baseline for detecting subtle changes over time.

Why Your Optometrist Might Detect Your High Cholesterol Before Your GP?

It may seem counterintuitive, but your optometrist is on the front lines of detecting cardiovascular risk factors, including high cholesterol. While your General Practitioner (GP) relies on blood tests, which you may only get periodically, your optometrist has a direct, yearly window into your vascular health. This puts them in a unique position to spot the physical evidence of systemic issues before you even feel symptoms or have a scheduled blood draw.

High cholesterol can lead to plaque buildup in blood vessels throughout the body, including the tiny arteries and veins in the retina. During a dilated eye exam, an optometrist can sometimes see these plaques, known as “Hollenhorst plaques,” which are tiny, bright, reflective pieces of cholesterol that have broken off from larger plaques elsewhere (often in the carotid artery) and traveled to the eye. This is a direct and serious warning sign of advanced atherosclerosis and a significantly increased risk of stroke.

More commonly, high cholesterol can be associated with an “arcus senilis”—a white, gray, or blueish ring around the edge of the cornea. While this is a normal sign of aging in older adults, its appearance in a patient under 40 is a strong indicator of high cholesterol and triglycerides and warrants an immediate referral to a GP for bloodwork. With a clear view of the blood vessels, an eye exam provides critical insights into a patient’s heart health, making the optometrist a vital, and often uncredited, member of your cardiovascular care team. This powerful example brings our core argument full circle: separating eye care from the rest of your health is not just a financial error, but a potentially life-threatening clinical one.

To put these strategies into practice, the next logical step is to review your current insurance plans and schedule a comprehensive exam, armed with the right questions for both the billing staff and the doctor.

Frequently Asked Questions on Eye Exam Billing

How often should diabetics get eye exams?

People with diabetes need yearly comprehensive vision exams, including dilated eye exams. These conditions can often be avoided or delayed with annual screening and early treatment, making it a critical part of diabetes management.

What are forgotten risk factors for eye disease?

Beyond common factors like age and family history, other risks include: high myopia (nearsightedness), which increases retinal detachment risk; African or Hispanic descent, which increases glaucoma risk; and the use of systemic medications like corticosteroids that can affect eye health.

When should exam frequency increase?

Your exam frequency should be re-evaluated annually with your optometrist. It should increase with age, a new health diagnosis (like diabetes or hypertension), significant changes to your medications, or the emergence of any new eye-related symptoms.